Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. The cryptocurrency market is highly volatile, and you should always conduct your own research (DYOR) and consult with a qualified professional before making any investment decisions.

You know how the crypto space never sits still? Lately, there’s been this huge buzz around Real-World Assets (RWA). It is the most talked-about topic in the town, but do you really care?

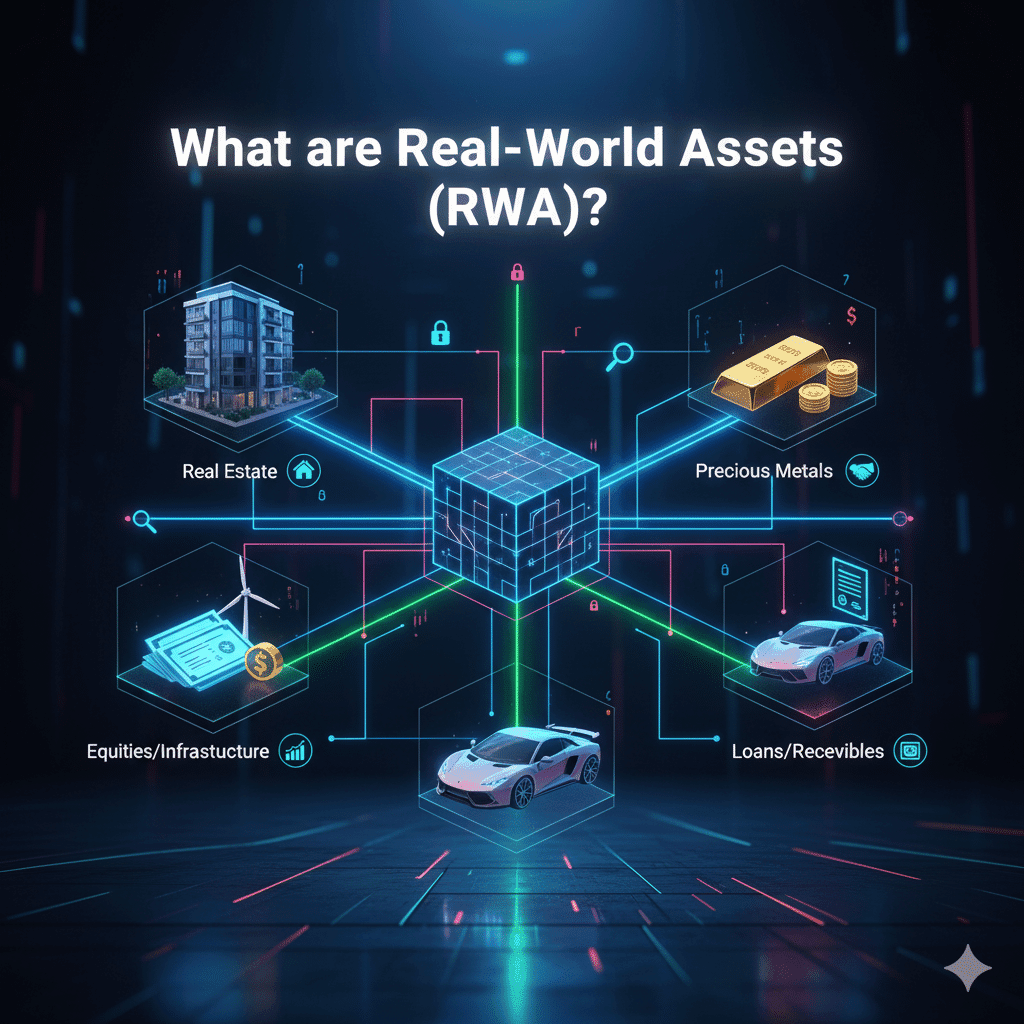

Real-World Assets (RWA) are pretty much what the name suggests—stuff from the actual, physical world. If we talk about the traditional assets that include gold, corporate bonds, real estate, or even unpaid invoices of your business.

What’s happening now is these physical or traditional financial assets are getting tokenized and brought onto the blockchain. It’s basically like building a bridge between traditional finance (the old guard) and decentralized finance (the new kid on the block), and suddenly, doors that were locked for decades are swinging wide open.

Understanding RWAs in the Financial Ecosystem

If you want to know the importance of real world assets, it is important to know that they are not groundbreaking discoveries. They have existed for a long time in the shape of Government-issued bonds, certificates of commodities, which are the main pillars of any country’s economy.

What’s different now is how we’re dealing with them. With RWA blockchain solutions coming into play, we can represent ownership of physical stuff digitally. No more getting buried under mountains of paperwork or twiddling your thumbs for weeks while transactions crawl through the system. You can trade, lend, or borrow these assets using smart contracts. Same finance, just faster, more transparent, and minus the geographical headaches.

Why Real-World Assets Matter in the Modern Economy

Now here it gets interesting, in the past, when anyone wanted to invest in real world assets or buy any commercial building, or credit opportunities, you had to have some serious cash in your account or proper connections. It has already been an exclusive club, and an ordinary person was not able to get the opportunities.

Tokenization throws that whole system out the window. Assets can now be chopped into smaller chunks—we call it fractional ownership—and traded whenever you want, day or night. That fancy apartment complex in Manhattan? Does that bond pay consistent returns?

Now you don’t need millions to invest in these real-world assets. This has the potential to change the world economy and democratize access to wealth-building tools for everyone.

What Is Asset Tokenization and How Does It Work?

Tokenization of real world assets means that the person owns something tangible that will be provided to them in the form of a digital token using blockchain.

Here’s a practical example:

Just imagine that you buy a real estate worth 1 Million, then you split this property into 1000 different digital tokens, now each token values 1/1000 th of the value instead entire property value. Now people can buy even a 1/1000th of that property instead of buying it whole. Now these tokens can also be sold on multiple platforms, or users can use them as collateral in DeFi apps.

Another thing that makes it interesting is the smart contracts. They create transparency between buyer and seller and handle security for the smooth execution of the transaction automatically. Now you don’t have to hire an attorney for each simple decision in your life.

To get yourself tokenized assets, you will need cryptocurrency like BTC and ETH for the purchase.

To get started with tokenized assets, you’ll first need cryptocurrency (like ETH or USDC) to make the purchase. It’s better to buy these coins through non-custodial platforms like Zavros Network before entering the world of tokenized RAW.

Why Tokenize Real-World Assets? The Core Advantages

If you tokenize real world assets, other than just creating digital paperwork, you are creating value for your asset in many ways.

Liquidity: Any kind of real-world assets, including artwork or even your house, can be sold into pieces by tokenizing them.

Accessibility: Being wealthy isn’t a prerequisite anymore. Start with whatever you can afford and build from there.

Transparency: The blockchain records every single transaction permanently.

Efficiency: This is how we can get rid of the middleman who always charges us the processing fee, and can directly communicate with buyers.

Global Reach: Now, someone who is halfway across the globe can invest in your assets through crypto real world assets platforms. Your location has become irrelevant to your purchase.

Someone halfway across the world in Singapore can invest in Texas property through crypto real world assets platforms. Location becomes irrelevant.

Step-by-Step: How Real-World Assets Are Tokenized

Let’s break down the process of tokenizing a physical asset and put it on the blockchain step by step:

Asset Selection: The first step is to choose what asset you are going to tokenize. It can be anything with real value.

Legal Structuring: You need solid legal frameworks, and you’ve got to comply with whatever regulations apply in your jurisdiction.

Asset Valuation: Get experts to properly assess what your asset is worth.

Token Creation: Now it’s time to mint RWA tokens that can either represent the whole asset or a share of its value.

On-Chain Listing: List these tokens to any RWA DeFi that is powered by a Blockchain marketplace that will allow you to find real investors.

Trading and Utility: Now, this is the last step, where the investors can lend out the tokenized RWAs just like any other digital asset.

Hopefully, these points will help explain Token standards explained for RWA.

Types of Real-World Assets That Can Be Tokenized

The main beauty of this technology is that it is flexible toward any kind of real world asset that holds value. Anything that has a paper value can be tokenized.

- Real Estate

- Commodities

- Debt Instruments

- Intellectual Property

- Art and Collectibles

- And Much More

The best part is that each category of real-world asset tokenization comes with a different set of benefits.

All these above mentioned area of business also use blockchain in supply chain for transparency and efficiency.

Key Benefits of Real-World Asset Tokenization

Let me spell out why this actually matters for regular people:

Enhanced Liquidity: Assets that would traditionally sit untouched for years can now be partially liquidated whenever needed.

24/7 Trading: Stock markets close. RWA blockchain markets don’t. They’re always open for business.

Reduced Costs: Each middleman you eliminate saves money. And trust me, traditional finance has plenty of them taking their percentage.

Improved Transparency: Blockchain technology creates unchangeable audit trails. Everything’s recorded forever.

Increased Security: Smart contracts work on predefined rules and execute automatically with best crypto payment gateway—much less opportunity for human mistakes or intentional fraud.

Challenges and Risks of Tokenizing Real-World Assets

Let’s get real about the obstacles, though. Tokenizing real world assets isn’t without its problems:

Regulatory Uncertainty: Different countries play by different rules. What flies in one place might get you in hot water somewhere else.

Valuation Issues: Pricing unique assets like rare properties or artwork? That’s more subjective than you’d think.

Custody and Compliance: At the end of the day, someone physically has to hold and protect that real-world asset. That responsibility doesn’t disappear.

Market Adoption: Because it’s a new territory for investors, it is important to educate people about this and it can take some time.

How Real-World Assets Are Powering DeFi Innovation

Now here’s where things get legitimately exciting. RWA DeFi (Real-World Assets in Decentralized Finance) is fundamentally changing how we think about bringing stable, income-generating assets onto blockchain networks.

Many companies are developing the actual infrastructure needed to connect verified real-world information to DeFi platforms. What this means practically is you can use RWA tokens as collateral for getting loans, earn interest by lending them to others, or participate in yield farming strategies—all while enjoying the stability of real-world assets instead of riding crypto’s wild price swings.

Comparing Real-World Assets vs. Digital Assets

| Feature | Real-World Assets (RWA) | Digital Assets |

| Backed By | Physical or financial assets | Purely digital (like Bitcoin, NFTs) |

| Stability | Generally more stable | Can be extremely volatile |

| Use Case | DeFi collateral, diversifying investments | Speculation, digital payments, ownership |

| Regulation | Must comply with existing frameworks | Still figuring out the rules |

Digital assets grab headlines and push innovation forward, but real-world assets on chain bring something equally crucial: dependability and trust that comes from tangible backing.

Legal and Regulatory Considerations in RWA Tokenization

Time to address the big, complicated elephant sitting in the room. For RWA crypto projects, regulatory compliance is probably the toughest challenge. Every country has different approaches to ownership laws, tax implications, and securities regulations. Even each state in a country can have different rules.

It is important to make sure of the following points if we need serious long-term success in this area.

- Know who your investors are in the industry.

- The custodians should be properly licensed with legal authority to hold real-world assets.

- The risks and potentials should be discussed with transparency.

- An absolute, crystal clear framework for the custodian.

It’s essential for getting investors to trust RWA tokens enough to put their money in.

The Future of Real-World Assets and Tokenized Finance

So where’s all this headed? The future of finance isn’t going to be purely traditional or completely decentralized. It’s going to be somewhere in the middle—a hybrid approach.

As people better understand RWA crypto meaning and see it working in practice, adoption rates will pick up speed. Industry experts aren’t being subtle—they’re predicting trillions (yeah, with a T) of dollars in real world assets moving onto blockchain networks over the next ten years. We’re looking at a genuine restructuring of the global financial system—one that’s more accessible, more transparent, and more liquid than anything we’ve had before.

Frequently Asked Questions About Real-World Assets (RWA)

1. What is RWA in crypto?

It is a representation of physical and financial assets in the form of digital tokens powered by a blockchain. Imagine converting your asset into a token and then trading it just like cryptocurrency through a reliable platform.

2. How are real world assets tokenized?

Through several steps: verifying the asset exists and has value, making sure everything’s legally compliant, getting professional valuations, and then creating blockchain-based tokens that represent ownership shares.

3. Are RWA tokens safe?

If they are properly regulated and verifiable, they are completely safe to invest in. It is just like any investment.

4. What are RWAs in DeFi?

They’re real-world assets being used inside decentralized finance systems—as collateral when you borrow money, as investment vehicles, or as ways to generate returns.

5. What is the future of RWA blockchain?

Multiple platforms are getting more specialized and trying to create a hybrid financial system that allows us to tokenize traditional assets and combine them with blockchain technology for innovation and efficiency.

Conclusion

Real-World Assets (RWA) aren’t just another trendy crypto term that’ll disappear next month. They represent a genuine, fundamental change in how financial systems operate. By tokenizing real world assets, we’re tearing down barriers that have kept regular people out of serious investment opportunities for generations.

The merging of real-world assets in crypto goes beyond simple innovation. It’s actually revolutionary in terms of how value can move globally. Whether you’re someone hunting for stability in crypto’s volatile markets or you’ve historically been shut out of traditional investment channels, RWAs are opening possibilities that didn’t exist before.

We’re watching the future get built in real-time—and it’s a future where traditional and digital finance blend together so seamlessly that the distinction stops mattering. What matters is that opportunities become available to everyone, not just the privileged few.

About the Author

Alex Carter is an on-chain analyst and crypto strategist with over six years of experience specializing in protocol analysis, decentralized finance (DeFi), and on-chain security. After beginning his career in cybersecurity, Alex pivoted to Web3 in 2018, fascinated by the complex economic interactions within blockchain ecosystems. He has published numerous analyses on MEV strategies and their impact on users, advocating for greater transparency and the adoption of protective technologies. Alex is a firm believer in a security-first, research-driven approach to the crypto space.