Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. The cryptocurrency market is highly volatile, and you should always conduct your own research (DYOR) and consult with a qualified professional before making any investment decisions.

How Do Crypto Credit Cards Work?

Ever wish you could spend your crypto as easily as cash? Or maybe earn Bitcoin back instead of airline miles? For a long time, bridging the gap between digital assets and everyday spending felt like a distant dream.

But that’s changing fast, thanks to crypto debit and credit cards. These clever pieces of plastic (or metal!) are making it simpler than ever to use your crypto in the real world.

Let’s break down How Crypto Credit Cards Work Explained, explore the debit card variations, and figure out if they’re right for you.

What Exactly Is a Crypto Credit Card?

So, what is a crypto card specifically designed as a credit card? Think of it like your standard Visa or Mastercard, but with a crypto twist, usually in the rewards.

You spend fiat currency (like USD, EUR, etc.) just like a normal credit card. The big difference is that instead of earning points or miles, you typically earn rewards paid out in cryptocurrency.

This is a fantastic way for folks to dip their toes into earning crypto without directly buying it.

How Crypto Credit Cards Function: From Rewards to Repayments

Here’s the typical flow for a crypto credit card:

- Spending: You use the card online or in stores, just like any other credit card. The merchant receives fiat currency.

- Rewards: Based on your spending, you earn a percentage back, automatically converted into a specific crypto (like Bitcoin, Ethereum, or the card issuer’s own token). These rewards accumulate in your associated account.

- Billing: You receive a monthly statement in fiat currency.

- Repayment: You pay your bill in fiat currency. Some cards might offer options to pay credit card with crypto, but this often involves selling your crypto first and can have tax implications. Fiat repayment is standard.

Advantages and Limitations of Crypto Credit Cards

Like anything in crypto, these cards have their upsides and downsides.

Advantages (Crypto Card Benefits):

- Earn Crypto Passively: Easily accumulate crypto just by making everyday purchases.

- Familiar Spending: No need to explain crypto to merchants; it works like a regular card.

- Potential Upside: Your crypto rewards could increase in value over time (though the opposite is also true!).

Limitations:

- Volatility Risk (Rewards): The value of your earned crypto rewards can fluctuate wildly.

- Fees: Watch out for annual fees, foreign transaction fees, or potential crypto conversion fees (less common on credit cards, more so on debit).

- Tax Complexity: Crypto rewards are often treated as income, and selling them triggers capital gains/losses. Keeping track can be a headache. Tax implications are crucial.

What Is a Crypto Debit Card and How Is It Different?

Now, let’s switch gears to the crypto debit card. This is fundamentally different from a credit card.

Instead of borrowing money to spend, a crypto debit card lets you spend the cryptocurrency you already own. It’s linked directly to your crypto wallet or account held with the card provider.

Think of it as a bridge, converting your crypto into fiat at the moment you pay.

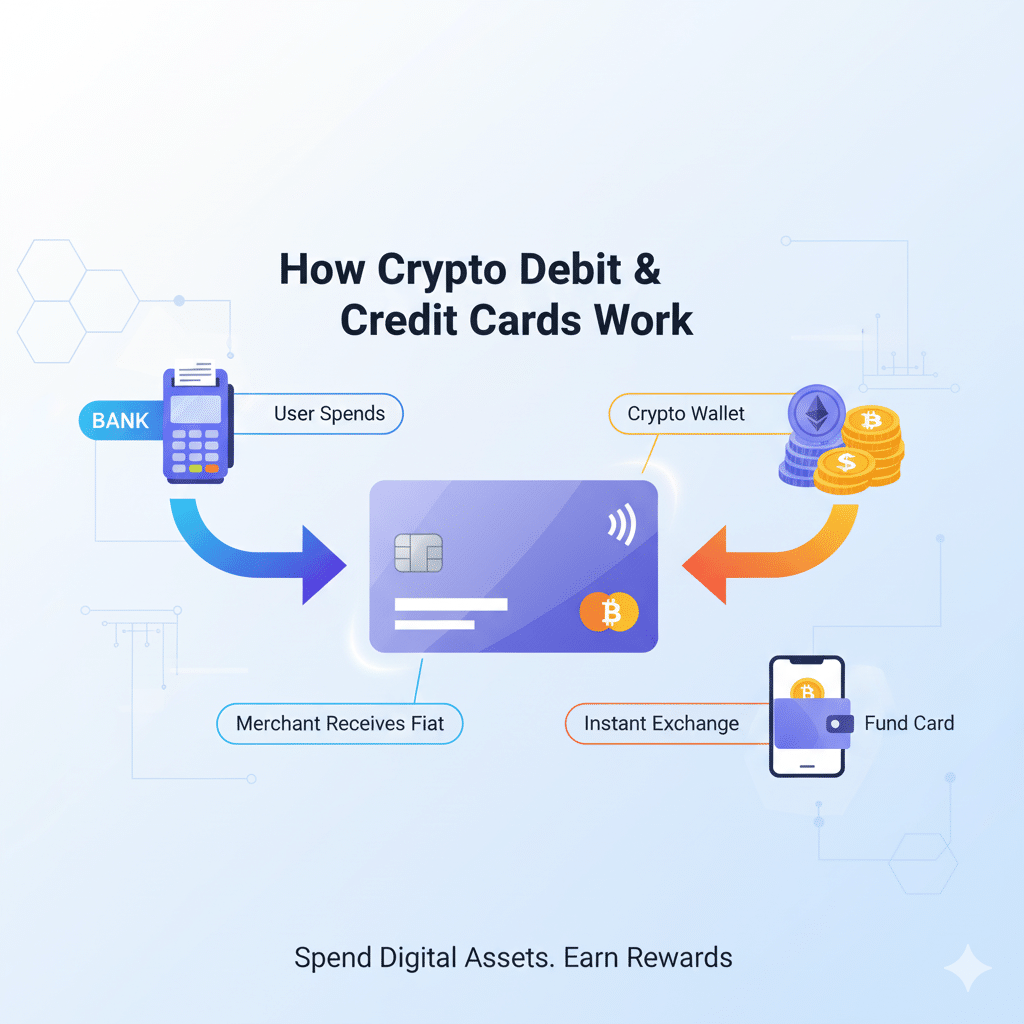

How Crypto Debit Cards Work in Real Life

Using a crypto currency debit card feels seamless, but there’s a lot happening behind the scenes:

- Funding: You load your card account with specific cryptocurrencies (e.g., BTC, ETH, USDC).

- Swiping/Tapping: You use the card at a point of sale (POS) terminal or online.

- Instant Conversion: The card provider instantly sells the necessary amount of your crypto to cover the fiat purchase price.

- Payment: The merchant receives the payment in their local fiat currency (e.g., USD, GBP).

This conversion happens in the background, making it feel just like using a regular debit card. Real-time conversion is key.

Crypto Credit vs. Debit Cards: Key Differences Explained

It’s easy to get confused, but the distinction is vital. From what I’ve seen, choosing the wrong one can lead to surprises.

- Crypto Credit Card:

- Spending: Borrows fiat currency.

- Funding: Based on your credit limit.

- Rewards: Earn crypto back on fiat spending.

- Repayment: Pay fiat bill monthly.

- Primary Risk: Standard credit card risks (debt, interest). Reward value volatility.

- Crypto Debit Card:

- Spending: Uses your existing crypto.

- Funding: Pre-loaded with your crypto assets.

- Rewards: Sometimes offers crypto rewards on spending (less common or lower rates than credit).

- Repayment: N/A (funds deducted instantly).

- Primary Risk: Spending potentially appreciating assets. Crypto volatility affects spending power. Taxable event on every purchase.

In short: Credit cards spend fiat & earn crypto rewards. Debit cards spend your crypto.

Challenges of Using Crypto for Everyday Spending

While these cards make it possible, using crypto directly (especially via debit cards) still presents challenges:

- Volatility: The biggest one. The value of your crypto can swing dramatically. That $5 coffee could cost you 0.0001 BTC today and 0.0002 BTC tomorrow. Planning is difficult.

- Taxable Events: In many countries (like the US), spending crypto is a taxable event. Every time you buy something with a crypto debit card, you’re technically selling crypto, which could trigger capital gains tax. This requires meticulous record-keeping. Reputable crypto tax software blogs often have guides on navigating this.

- Fees: Conversion fees, network fees (less common with cards but possible), ATM withdrawal fees – they can add up.

Where Can You Use Crypto Credit and Debit Cards?

Here’s the good news: most crypto card visa or Mastercard options work anywhere Visa or Mastercard is accepted. That’s millions of merchants worldwide.

The merchant doesn’t need to know anything about crypto. As far as they’re concerned, it’s just another card transaction settled in their local currency. Acceptance mirrors traditional cards.

The Future of Crypto Cards: Bridging Blockchain and Traditional Finance

Crypto cards are more than just a novelty; they’re a crucial bridge. From my perspective, they represent a vital step in making digital assets practical for everyday life.

We’re likely to see more integration with DeFi, perhaps cards linked directly to staking yields (what is staking in crypto provides passive income that could potentially fund card spending) or borrowing protocols.

The technology is also evolving, potentially integrating features related to NFT Use Cases Beyond Art, like using your card to access exclusive events tied to an NFT you own.

Choosing the Right Crypto Card for Your Needs

With more options appearing, how do you pick? Consider:

- Credit vs. Debit: Do you want to earn rewards on fiat spending (credit) or spend your existing crypto (debit)?

- Reward Crypto: Which specific crypto do you want to earn? Does the card offer flexibility?

- Fees: Check the annual fee, conversion fees, foreign transaction fees, ATM fees. Read the fine print!

- Supported Cryptos (Debit): Which coins can you load and spend?

- Availability: Is the card available in your country?

- Perks: Any extra benefits like airport lounge access or subscription rebates?

Do your research just like you would for any financial product. Compare features carefully.

FAQs About How Crypto Credit Cards Work

Let’s tackle some common questions:

Do I need to hold crypto to use a crypto credit card?

Generally, no. You spend fiat currency and earn crypto rewards. You don’t usually need to own crypto beforehand, although the rewards will be deposited into a crypto account managed by the card issuer.

Can I earn Bitcoin as cashback rewards?

Yes! Many crypto credit cards offer Bitcoin as a primary reward option, alongside other popular cryptocurrencies like Ethereum or stablecoins.

Is KYC mandatory for every crypto card?

Yes. Due to financial regulations (Know Your Customer/Anti-Money Laundering laws), you will need to verify your identity to get any legitimate crypto credit or debit card, just like opening a bank account.

Can I withdraw cash with either type of card?

Usually, yes. Both types often function on major networks like Visa/Mastercard and allow ATM withdrawals. However, be very mindful of the fees for crypto debit cards, as withdrawing cash involves selling crypto plus potential ATM operator fees.

What happens if the value of my crypto drops?

- Credit Card Rewards: The value of the crypto you’ve already earned will drop. If you earned $10 worth of BTC and BTC drops 50%, your rewards are now worth $5.

- Debit Card Spending: Your spending power drops. If you have 1 ETH loaded and its value falls, you can buy less with that 1 ETH. You might need to load more crypto or spend less.

Key Takeaways: Bridging Worlds

How Crypto Debit or Credit Cards Work Explained boils down to this: they are innovative tools making crypto more accessible and usable.

Credit cards let you earn digital assets on everyday spending, while debit cards let you spend the crypto you already hold. Both come with unique benefits and risks, especially concerning volatility and taxes.

They aren’t perfect, but they represent a significant step towards integrating the world of blockchain with traditional finance, making crypto less abstract and more tangible for millions. Choose wisely, understand the risks, and they can be a powerful addition to your financial toolkit.

About the Author

Alex Carter is an on-chain analyst and crypto strategist with over six years of experience specializing in protocol analysis, decentralized finance (DeFi), and on-chain security. After beginning his career in cybersecurity, Alex pivoted to Web3 in 2018, fascinated by the complex economic interactions within blockchain ecosystems. He has published numerous analyses on MEV strategies and their impact on users, advocating for greater transparency and the adoption of protective technologies. Alex is a firm believer in a security-first, research-driven approach to the crypto space.