Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. The cryptocurrency market is highly volatile, and you should always conduct your own research (DYOR) and consult with a qualified professional before making any investment decisions.

ERC20 vs TRC20 USDT Differences: Complete Comparison Guide

If you’ve ever moved the stablecoin Tether (USDT) between wallets or exchanges, you’ve likely been hit with a choice: send it as an ERC-20, a TRC-20, or a BEP-20 token? It can feel a bit confusing, right? You have the same asset, USDT, but it exists in multiple forms. Think of it like this: the US dollar is the same currency whether it’s in a bank in New York, London, or Tokyo. The banks are different networks, but the dollar’s value remains the same.

This is the core of our topic today: Token Standards Explained: ERC-20, BEP-20, TRC-20 & Others. We’ll break down exactly what these standards mean, why they matter, and how to choose the right one for your needs.

Understanding USDT Token Standards and Blockchain Networks

A token standard is essentially a blueprint or a set of rules for creating and issuing tokens on a specific blockchain. These rules, which are built into the blockchain’s smart contracts on blockchain, ensure that all tokens following that standard can interact seamlessly with each other, as well as with dApps, wallets, and exchanges within that ecosystem.

When we talk about USDT TRC20 or USDT BEP20, we are referring to the same Tether stablecoin, but issued on different blockchains (TRON and BNB Smart Chain, respectively). The underlying asset is identical; the “wrapper” and the “highway” it travels on are what’s different.

USDT on Ethereum (ERC20): How It Works and Key Features

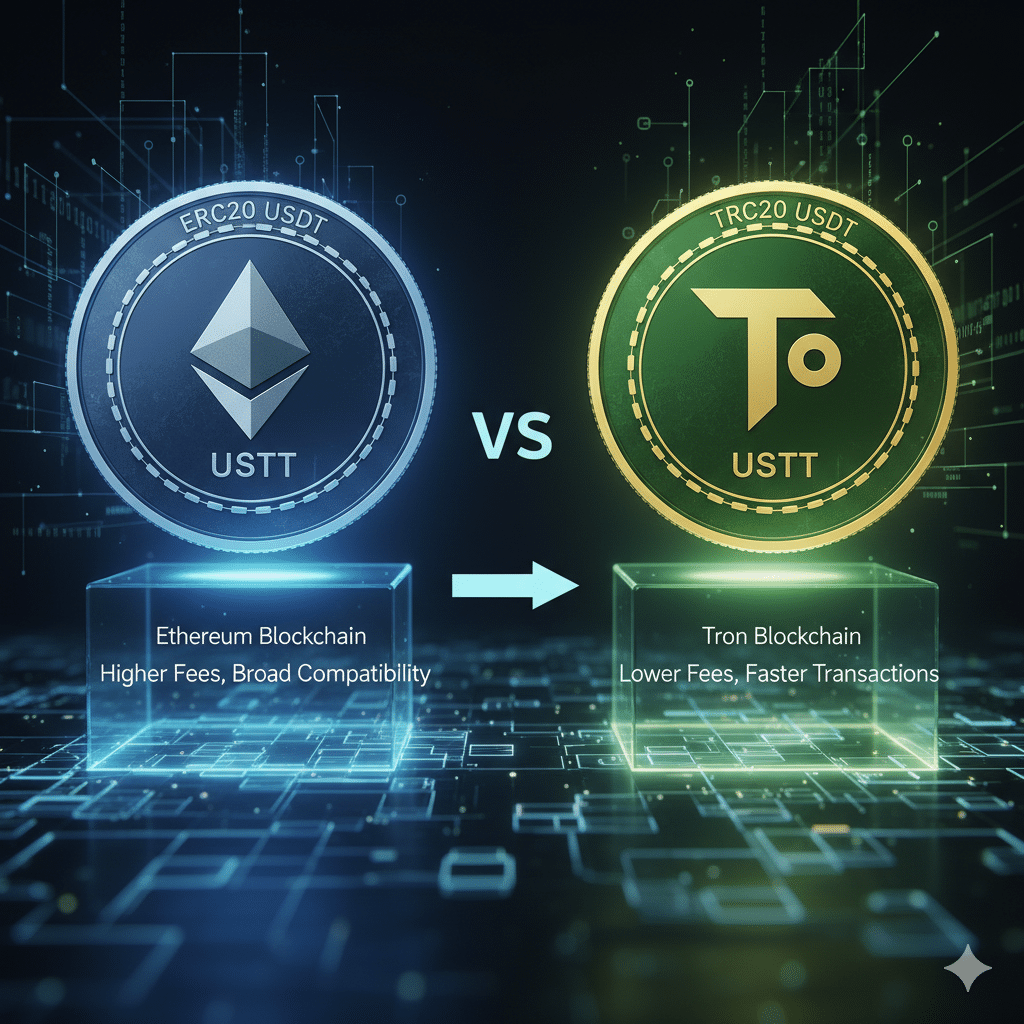

So, what is USDT ERC20? This is the version of Tether that lives on the Ethereum blockchain. The ERC-20 standard is the most widely adopted and established token standard in the crypto world.

- Key Features:

- Massive Ecosystem: As the original smart contract platform, Ethereum has the largest, most liquid DeFi ecosystem. It’s a world of lending, borrowing, and trading that simply wouldn’t be possible without critical infrastructure. Understanding the role of oracles in Blockchain & DeFi—which feed these smart contracts essential real-world data like asset prices—is key to grasping why this ecosystem is so powerful. This vast utility is why ERC20 USDT is accepted almost everywhere.

- High Security: The Ethereum network is secured by a vast, decentralized network of nodes, building on the principles of how validator nodes work to maintain robust security.

- Primary Drawback: Transaction fees, or “gas,” on Ethereum can be very high during periods of network congestion.

Many people ask, “is Tether an ERC20 token?” The answer is yes, the original and most widely held version of Tether is an ERC-20 token. You can view its contract and transaction history on a blockchain explorer like Etherscan.

USDT on TRON (TRC20): Benefits, Speed, and Cost Efficiency

If ERC-20 USDT is the established giant, then TRC-20 USDT is the nimble and cost-effective challenger. What is USDT TRC20? It’s Tether issued on the TRON blockchain, which was designed specifically for high-throughput, low-cost transactions.

- Key Features:

- Extremely Low Fees: The primary advantage of using TRC 20 USDT is the cost. Transactions often cost just a few cents, a stark contrast to Ethereum’s potential fees.

- High Speed: TRON’s network confirms transactions in seconds, making it ideal for frequent payments and transfers.

- Growing Adoption: Due to its efficiency, TRC20 crypto has become incredibly popular, especially in developing markets and for peer-to-peer transactions.

USDT on BNB Smart Chain (BEP20): Use Cases and Ecosystem Overview

The BEP-20 standard is the token blueprint for the BNB Smart Chain (BSC). What network is BEP20 associated with? It’s the blockchain backed by Binance, the world’s largest crypto exchange. This has given USDT BEP20 a massive built-in user base.

- Key Features:

- Low Fees & Fast Transactions: BSC offers a middle ground, providing significantly lower fees and faster speeds than Ethereum, though often not as cheap as TRON.

- Vibrant DeFi Ecosystem: BSC has a huge and active ecosystem of decentralized applications, from exchanges like PancakeSwap to various lending and borrowing protocols, where BEP20 USDT is a core asset.

- The BEP20 meaning is simply the rulebook that allows tokens like USDT to function within this bustling ecosystem.

USDT on TON Network: Emerging Adoption and Advantages

A newer player gaining significant traction as of late 2025 is USDT on the TON (The Open Network) blockchain. Originally designed by Telegram, TON is built for massive scalability, aiming to process millions of transactions per second. USDT’s integration here is a game-changer, offering users an incredibly fast and cheap way to transact, often directly within the Telegram messenger app. Its main advantage is tapping into Telegram’s enormous user base, making crypto transfers feel as simple as sending a message.

ERC20 vs TRC20 vs BEP20: Comparison of Transaction Fees, Speed, and Wallet Support

Let’s put it all together. From my experience in the market, the choice almost always comes down to a trade-off between cost, speed, and ecosystem access.

| Feature | USDT ERC-20 (Ethereum) | USDT TRC-20 (TRON) | USDT BEP-20 (BNB Chain) |

| Transaction Fees | High ($2 – $50+) | Very Low (~$0.01 – $1) | Low ($0.10 – $0.50) |

| Transaction Speed | Slower (1-5 minutes) | Very Fast (seconds) | Fast (~3-5 seconds) |

| Ecosystem | Largest, most established DeFi | Growing, popular for payments | Large, diverse DeFi and GameFi |

| Wallet Address | Starts with “0x” | Starts with “T” | Starts with “0x” |

Crucial Note: Wallet addresses for ERC-20 and BEP-20 look identical (both start with “0x”). Sending tokens to the wrong network can result in a permanent loss of funds. Always double-check that you are using the correct network.

Choosing the Right USDT Format for Transfers, Trading, or Payments

So, which one should you use?

- For DeFi Power Users: If you’re interacting with major protocols like Aave or Uniswap, you’ll almost certainly need USDT-ERC20.

- For Frequent, Small Payments: If you’re sending USDT to friends or making regular payments, TRC20-USDT is the undisputed king due to its near-zero fees.

- For BSC Ecosystem Users: If you’re active on PancakeSwap or other BSC dApps, USDT BEP 20 is your native choice.

Accepting Payments and Exchanging USDT Across Multiple Networks

For merchants or individuals who frequently handle USDT, managing these different versions is key. Many centralized exchanges allow you to deposit USDT from one network (e.g., TRC-20) and withdraw it on another (e.g., ERC-20).

Alternatively, if you prefer to maintain full control over your assets, you can use a non-custodial platform. For example, a crypto retail platform like the Zavros Network allows you to buy and sell crypto directly, giving you the flexibility to manage your assets across different chains without ever giving up your private keys.

How to Choose the Right Token Standard for Your Project or Business

If you’re a developer or entrepreneur, your choice of token standard depends entirely on your target audience and use case.

- Targeting the largest liquidity and DeFi user base? Build on Ethereum (ERC-20).

- Building a high-volume payment application? TRON (TRC-20) offers the best cost structure.

- Want to tap into a massive retail trading audience with low fees? BNB Smart Chain (BEP-20) is a powerful option.

Ultimately, understanding these token standards moves you from being a casual crypto user to a knowledgeable participant who can navigate the multi-chain world with confidence and efficiency.

About the Author

Alex Carter is an on-chain analyst and crypto strategist with over six years of experience specializing in protocol analysis, decentralized finance (DeFi), and on-chain security. After beginning his career in cybersecurity, Alex pivoted to Web3 in 2018, fascinated by the complex economic interactions within blockchain ecosystems. He has published numerous analyses on MEV strategies and their impact on users, advocating for greater transparency and the adoption of protective technologies. Alex is a firm believer in a security-first, research-driven approach to the crypto space.